Pin Bar Trading Strategy

Contents:

A third reversal attempt has a higher probability of being successful. March 9, 2020 high and the June 10, 2020 high were breakout points for last year’s strong rally therefore strong magnets. The bulls want a reversal up from a double bottom with the October 12 low and a major trend reversal even if EURUSD trades slightly below October’s low.

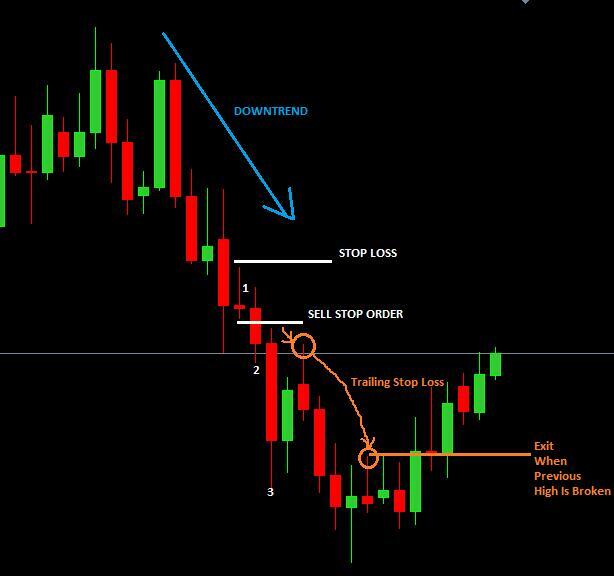

Set your stop loss on the opposite side of your trade entry, 2-5 pips away from the low for a buy-stop order and 2-5 pips above the high for a sell-stop order. Price makes a swing higher and then forms the very obvious outside bar. Price has a higher high and also a lower low than the previous candlestick. The risk when taking an aggressive entry is price may go green and then stall and reverse.

Understanding an Outside Reversal pattern

For the first reversal pattern, we see the OB take out the high of the previous candle, and then rip right through to take out the lows. The higher time frame chart is an uptrend and this chart has put in a higher low after a lower high. Traders are long in an established trend and the big green candle brings in more bulls.

NFT NYC Again Showcased the Resilience of Web3 Culture – Decrypt

NFT NYC Again Showcased the Resilience of Web3 Culture.

Posted: Mon, 17 Apr 2023 01:51:49 GMT [source]

This is the point where the price makes a reversal that is going to last for the next few days. Similarly, when the bearish outside bar candlestick pattern shows up, the price reverses towards the downtrend. An outside reversal pattern is typically one of the more precise candlestick patterns; however, these patterns require a strict definition to be useful forecasting tools.

Inside Bar: Stop loss

The highest probability pin bars are reversal signals that come after a prolonged price move. The pin bar candlestick pattern is one of the most powerful and easily recognizable candle patterns available. Measure Distance based on the Size of the Pin Bar – Trades can use this approach for exiting candle pattern based trades. You can use one, two, or three times the size of the pin bar to determine the target. It is up to you which multiplier you would like to use in your own trading program. However, whatever you decide on when you build your pin bar strategy, make sure to use the same target approach for every trade – one, two, or three times the size of the pin bar.

You may also want to consider taking partial profits if the trade moves in your favor. The first thing to look for is an outside bar set up on the forex charts. This means you are looking for a candlestick pattern that meets the criteria of an outside bar as discussed.

Set your entry point above the close of the engulfing candlestick in case of a bullish outside bar pattern. If you’ve taken the first tip we’ve mentioned, that means you would be trading soon after the opening of the candlestick that follows the pattern. The reason this is a trap is that there are times when the price shoots up instantly, only to slump down just as rapidly within a short period of time. What we have in the end is a candlestick with a very long wick. It’s not an outside bar candlestick pattern if the engulfing candlestick has not been closed.

I set out with the goal to create the trading program that… The Average True Range indicator is a very popular trading indicator that can be used in many different trading situations.

The Hikkake candle pattern represents the failure of the inside bar. When the inside bar pattern fails and returns to break the opposite level of the range, within 2-3 bars, we confirm a Hikkake pattern. In this manner, we can trade the Forex pair in the opposite direction to the initial Inside Bar trade entry.

Trading Room

Think of the “mother bar” of an inside bar pattern being on the opposite side of price. For more information on trading pin bars and other price action patterns, click here. Another way to confirm the trade entry is to look for additional candlestick patterns or technical indicators to support the outside bar setup. During the initial decline, the price action creates an inside bar candle formation on the chart.

An outside bar pattern is a two candle pattern that has a large candle engulf a previous smaller candle on a chart by both going above and below the previous candle highs and lows. A bullish outside bar candlestick goes lower than the previous candle lows and then closes higher than the previous candle highs. A bearish outside bar candlestick goes higher than the previous candle highs and then closes lower than the previous candle lows. Sometimes the large candle in the pattern is also called the mother bar candle and the smaller candle is called the baby candle.

The blue circle on the price graph above shows an inside bar candlestick pattern. See that the highest and the lowest points of the small bullish candle are fully contained within the previous bearish candle. The black horizontal lines on the image define the inside bar range – the high and the low of the pattern. When you spot a breakout through one of these two levels, then that would give you a signal in the direction of the breakout. In our case the price action breaks the inside range in bullish direction.

That increases the chance of several sideways days over the coming week. There will probably be a trading range lasting at least a couple weeks at some point before the end of the year. Traders are still deciding if the breakout above the 4-month trading range will succeed.

Inside Bar: Entries, stops, and exits

The key is that the outside bar closed red which sets up a potential reversal. Another cause of outside candlestick formations is increased volatility in the market. This can happen when there is uncertainty or disagreement about the value of a security, causing traders to engage in more active buying and selling.

In this article you’ll learn everything you need to know about the powerful outside bar candlestick pattern and how to use it in your forex trading. After a long momentum candlestick, the momentum suddenly drops off and signals a lack of trend support. In the screenshot below, the downtrend came to an abrupt end when multiple consecutive small inside bar candles were created after the long momentum candlestick. After three inside bars, the momentum then suddenly turned and a strong outside bar reversed the price higher. This is a classic reversal sequence and it nicely shows the turning momentum. When you discover an inside bar breakout on the chart, you will most likely want to trade in the direction of the breakout.

It is usually an expanding triangle on a smaller time frame. Friday’s big bear bar increased the chance that it will happen within a couple of weeks. The bulls want a reversal up from a wedge bull flag and a micro double bottom with the October 12 low. March 2020 high and June 2020 high are breakout points for the strong rally last year and are therefore magnets. While the move down since September is in a tight channel, many of the bars are overlapping the prior bars.

Hypothetical performance results have many inherent limitations, some of which are described below. The move-up since October 13 is in a tight bull channel which means relentless bulls. That means a pullback that is at least 50% bigger than the biggest prior pullback. Here, the trend will remain intact until there is at least a 15% correction. The bears want a 2nd sideways to down leg from a wedge bear flag and a measured move down.

- As you already know, in Forex trading nothing is 100% certain.

- For example if you are looking to go long from a bullish outside bar you could place your stop loss below the low of the candlestick.

- You should aim to risk no more than 1-2% of your trading account on any given trade.

- This example above is a classic bullish Engulfing bar setup.

- Its relative position can be at the top, the middle or the bottom of the prior bar.

And if you did recognize this, you would be one hundred percent correct, as they are one in the same. The hammer and the shooting star are types of pin bar variations. There is always going to be at least a 40% chance that a breakout will fail. It means a transformation into a trading range, where the probability would be around 50 – 50, just like in the September selloff. That is why I kept saying that there was a 50% chance that it would reverse up to a new high. But the bears will need at least a micro double top or a few consecutive bear bars closing near their lows before traders will think about a possible reversal down.

Price Action E-Book

With Stop Loss Clusters outside bar tradingAlways wait for the closing of engulfing candlestick before you enter a position. You’re putting yourself at risk of encountering a fakeout otherwise. Three outside up/down are patterns of three candlesticks on indicator charts that often signal a reversal in trend. Bullish Outside Bar looks exactly opposite – like you can see in the chart below. It is usually the best if the bearish Outside Bar closes near its low price level and bullish Outside Bar closes near its high price level.

Inside days are candlestick charts that occur within the bounds of a previous days’ highs and lows. The stronger is a particular trend, the higher are its chances of reversal. This happens because sell orders dry up and everybody starts placing their buy orders in case of a bearish trend reversal.

Outside Bar Strategy

We are now watching for a break higher of the outside day signal to confirm the bullish momentum and trigger us into a long position. The setup was triggered when the highs of the Outside Candle were broken. The market initially stalled after the trade was triggered but quickly found it’s footing again, now this trade setup has pushed rapidly into some nice profit. I look for an established trend and use Engulfing bar setups to enter in the direction of the trend.

https://forexhero.info/ Pin Bar – When you identify a valid bullish pin bar you could buy the Forex pair at the first candlestick which closes above the small wick of the pin bar. An engulfing bar is a candle whose range exceeds the previous candle’s range. If the first candle is bullish, the previous candle must be bearish, or vice versa. The setup typically consists of a candle whose range exceeds the previous candle’s range, i.e., the second candle’s wicks are higher and lower than the previous candle. If the first candle is bullish/green, the second candle must be bearish/red, or vice versa. A bullish Engulfing bar pattern appeared on this EUR/USD Weekly chart which lined up nicely with a support level, giving me a textbook entry.

Succession’s Jeremy Strong teases Kendall’s victory after ‘DNA’ clue – Express

Succession’s Jeremy Strong teases Kendall’s victory after ‘DNA’ clue.

Posted: Tue, 18 Apr 2023 19:30:00 GMT [source]

This does not mean you will simply trade them as they appear. The Bollinger Bands is a technical indicator that was developed by John Bollinger and consist of a center line and two price channels above and below the middle line. Be sure you practice identifying and trading them on a demo account before trading them with real money. The outside bar is an obvious candlestick to find on a chart.