One Cancels Other Order OCO: Day Trading Terminology

Contents:

Becoming an experienced trader takes hard work, dedication and a significant amount of time. To ensure everything will proceed according to plan, the investor will place an OCO order. The order will consist of stop loss order with the goal of selling 1,000 shares at $10 and a limit order to sell the same shares at $16. Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options.

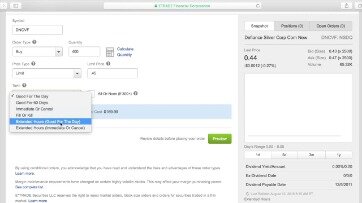

Please refer to the video above or continue to the written instructions below to learn how to set up an OTOCO or OCO order in your account. An investor has the ability of placing two orders which increases the probability of profits. If one of the orders does not work as intended, instead of being placed in a short position, the trading platform will cancel automatically the other order that did not execute.

This will result in the cancellation of the $10 stop loss order automatically by the trading platform. A stop order allows traders to execute trades if the market moves against their intended targets. For example, if a trader has set a stop order somewhere below the market price and the market suddenly goes down, the stop order will automatically be executed to limit the loss. However, even if the asset you’re trading isn’t in a bear market, many traders use OCO orders for the same purpose. That’s because you can pre-determine two different outcomes.

How do I sell with OCO?

In trading terms, they provided a way to sell at a higher price or to place a stop limit to sell if it goes below a certain price. To set this, click on the arrow beside the OCO and select OCO from the list. This will add more fields where you can place your price and quantity.

Note that manually canceling one of the orders will also cancel the other one. An OCO, or “One Cancels the Other” order allows you to place two orders at the same time. It combines a limit https://day-trading.info/ order, with a stop-limit order, but only one of the two can be executed. OCO orders may contrast with order-sends-order conditions that trigger, rather than cancel, a second order.

This special type of order can be useful for locking profits, limiting risks, and even for entering and exiting positions. Still, it’s important to have a good understanding of limit and stop-limit orders before using OCO orders. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not invest money that you cannot afford to lose. Bitfinex is a digital asset trading platform offering state-of-the-art services for digital currency traders and global liquidity providers.

How to place an OCO Order

OCO orders are used when creating a bracket on an existing Position. OCO’s allow you to set up and route a profit and stop-loss target simultaneously. When using an OCO or OTOCO for any futures position, please be aware that stop market orders are subject to CME’s Market Order with Protection handling. To learn more about this and how it may affect your stop market order, please click here. Experienced traders implement different strategies in order to take advantage of the market and profit.

One of the strategies that is perfect for both experienced and beginners is the One Cancels Other order. At the same time, you place 2 sell orders, one at stop loss for $23 and one at a limit of $27. The stock drops to $30, which triggers a buy order of XYZ stock that executes and… Below are the orders that are on the OCO/OSO pull-down. The templates have default order types and actions, but you can change them. For more information, contact Client Services through the Client Center link on the Help menu.

If we apply this analogy to financial markets, you can better understand the idea behind a one-cancels-the-other order. With this trading order, the investor creates a plan if the asset they’re trading rises or falls in value. Key in the trigger price and limit price for the stop-limit order. Select the quantity of cryptocurrency that you want to trade. For example, the stop-limit order will be triggered when the price drops to 1,500 , and the limit order will be canceled simultaneously. However, if the price goes up to 3,000 or above, the limit order will be executed automatically and the stop-limit order will be canceled.

TT Order Types

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Cryptocurrency assets are not subject to Federal Deposit Insurance Corporation or Securities Investor Protection Corporation coverage. Cryptocurrency trading is not suitable for all investors due to the number of risks involved.

If the stock trades up to $13, the limit order to sell executes, and the investor’s holding of 1,000 shares sells at $13. Concurrently, the $8 stop-loss order is automatically canceled by the trading platform. It’s a pair of conditional orders specifying that if either one of the orders is executed, the other order is automatically canceled.

Stock Order Types Guide

CoinMarketCap is not responsible for the success or authenticity of any project, we aim to act as a neutral informational resource for end-users. Conversely, other exchanges entail users to pair orders manually. Exchanges that fall under this category may require traders to create orders independently and bundle them together to create an OCO. Let’s explore an example where a trader is interested in buying Bitcoin and Ethereum but does not have enough capital to invest in the two assets at once. In this scenario, the trade can wrap two different buy orders in an OCO that would initiate at specific prices. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

Supporting documentation for any claims, if applicable, will be furnished upon request. With a one-cancels-the-other order , 2 orders are live so that if either executes, the other is automatically triggered to cancel. For OTO orders that are good ’til canceled , the whole order is good for 180 days (e.g., if the primary order executes on day 30, the secondary order is live for 150 days). A multi-contingent order triggers an equity or option order based on a combination of 2 trigger values for any stock or up to 40 selected indexes. The criteria can be linked by “and at the same time,” “or,” or “then.” A contingent order triggers an equity or options order based on any one of 8 trigger values for any stock, up to 40 selected indexes, or any valid options contract.

For this next configuration, the TT OCO is configured to submit a Stop Market order. However, the Payup setting is ignored for Market orders. No spam — just heaps of sweet content and industry updates in the crypto space. Recent market volatility has caused stablecoins to deviate from its peg — here’s a look at why. Slippage occurs when an order is filled at a price that is different from the requested price. The difference between the expected fill price and the actual fill price is the “slippage”.

Trade forex with IG

Currently, the web browser platform will display each working part of the bracket order as an individual order. The ability to view the entire bracket order as a group, similar to the desktop and mobile platform, is coming soon. See Managing Orders on Orders and Positions to learn how to create an OCO from an open order and to combine existing orders into a single OCO.

The second component is a stop order, which is to sell the stock if the price falls below $45. When either of these conditions is met, the other order will automatically be canceled, which means that only one of the two orders will be executed. The crypto market is known for its wild price swings and how it offers more profit-generating opportunities. Although volatility unlocks mouthwatering opportunities, it also breeds risks.

At the same time, the order can be used to mitigate risk if the price level falls. For example, suppose the price breaks above the resistance level or below the support level. Traders can then place a buy-stop or sell-stop at appropriate price points to enter or exit the market. In such cases, traders can opt to place an OCO order with a buy limit or a sell limit.

However, the most common reason for OCO orders is because it is a good exit strategy. Whichever comes first is the order that will be executed. Suppose an investor owns a stock that is currently trading at $50 per share. They are willing to sell it if the price falls below $45 to limit their losses, and are also willing to take profits if the price goes up to $55.

What does OCO mean in trading?

One-cancels-the-other (OCO) is a type of conditional order for a pair of orders in which the execution of one automatically cancels the other.

Also, the OCO order helps traders base their investment decision on favorable pricing conditions. In other words, you can set up your OCO order that initiates a buy order when either of your preferred assets reaches your preferred price target. The trader in our example can set a stop-loss order if a correction pushes the price of BTC below $17,000. This order type can be paired with a sell limit order that takes profit when the price of Bitcoin hits the $23,000 price mark. With this, the trader has successfully taken advantage of an OCO order to increase returns while reducing the risk exposure. But with an OCO order, you can both set it to sell at $99 and at the same time, set it to sell at $101.

Setting start and end times for a TT OCO parent order

On Binance, OCO orders can be placed as a pair of buying or selling orders. You can find more information about OCO orders by clicking on the “i” mark. Examples, response types, property details and explanations.

An order-sends-order , aka order-triggers-other , is a set of orders stipulating that if the primary order executes, then one or more secondary orders also will be placed. Stock trading involves buying and selling shares of publicly traded companies. It typically happens in the United States on exchanges like the New York Stock Exchange or the Nasdaq stock market. One-cancels-the-other is a type of conditional order for a pair of orders in which the execution of one automatically cancels the other.

If traders want to trade breakouts, they can opt to place an OCO order. In this case, we have set it to trigger if the price goes below $64.67 and hantec markets vs cmc markets to sell at a price of $64.55. You can create an OCO order with a limit order at 500 BUSD and a stop-limit order with a stop price of 540 BUSD.

- When using an OCO or OTOCO for any futures position, please be aware that stop market orders are subject to CME’s Market Order with Protection handling.

- Investopedia requires writers to use primary sources to support their work.

- You can then set the stop-limit order’s limit price to 550 BUSD, so the order will likely be filled.

- At a minimum, these studies indicate at least 50% of aspiring day traders will not be profitable.

Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. In our crypto guides, we explore bitcoin and other popular coins and tokens to help you better navigate the crypto jungle. Click on “Conditional” and then select “Limit.” Phemex categorizes OCO orders as conditional orders. Note that users need to pay for Phemex Premium to enable Conditional Orders.

What is OCO trading in Binance?

Intermediate. A ‘One Cancels the Other’ (OCO) order consists of a pair of orders that are created concurrently, but it is only possible for one of them to be executed. This means that as soon as one of the orders get fully or partially filled, the other one will be automatically canceled.